Bull Bitcoin X2 Valour is an exchange-traded product that provides double the daily exposure to Bitcoin’s price movements. Designed for experienced investors looking to capitalize on short-term bullish trends, it amplifies daily returns, offering a tactical tool for enhanced positioning. Bull Bitcoin X2 Valour is ideal for experienced investors seeking to increase their exposure to positive Bitcoin momentum or make agile portfolio adjustments in response to market shifts.

Valour’s Certificate product line includes Bull- and Bear-certificates (Daily Constant Leverage Certificates) on futures contracts based on Kaiko Constant Duration Indices. Traded on regulated exchanges and MTFs, these certificates provide transparent pricing and liquidity, giving investors the ability to take leveraged long or short positions on digital asset futures markets. Valour’s Base Prospectuses are approved by the Swedish Financial Supervisory Authority, meeting EU requirements for completeness, clarity, and consistency.

- Product NameBull Bitcoin X2 Valour

- IssuerValour Inc

- Base CurrencySEK

- Management Fee1.9%

- ISINCH1108679809

- Valoren110867980

- WKNA4A5T1

- Bloomberg Code2574597D SS

- Expiry DateOpen-ended

- Average Price89095.125USD

- Exchange Rate8.9587SEK

- Multiplier×0.0001000

- ETP Price75.75SEK

If you hold a Bull certificate and the price of the underlying asset drops sharply, there is a predefined barrier level. If this barrier is reached or breached, the certificate is knocked out—it immediately stops trading and expires. The residual value is zero, meaning you lose your entire investment, but never more than your invested amount.

If you wish to maintain exposure to the same asset, a new Bull certificate will be available for trading.

The opposite applies to Bear certificates: If the price of the underlying asset instead rises sharply, the barrier is breached and the Bear certificate is knocked out—with the same effect as for Bull certificates in a falling market.

Yes, with a leverage of -1. An important difference is that Valour Short Bitcoin tracks spot Bitcoin and not an underlying index of futures.

The products track VALOUR-KAIKO CDF BTCUSD and VALOUR-KAIKO CDF ETHUSD, indices based on two different futures for each underlying asset. You can read more about the futures index here: https://www.kaiko.com/indices-resources

No, it cannot be eliminated. However, it’s important to understand that these products are best suited for short-term strategies, not long-term investments.

Contango: Futures prices are higher than the spot price. This typically has a negative effect on Bull products.

Backwardation: Futures prices are lower than the spot price. This typically has a positive effect on Bull products.

For Bear products, the effect is the opposite.

Some leveraged products are based on futures contracts, which have an expiry date (however, Valour ETPs do not have an expiration date). When a contract nears expiry, the position must be rolled — meaning the old contract is sold and replaced with a new one with a later maturity date.

If the market moves consistently in your favor (e.g., up for Bull, down for Bear), daily rebalancing can enhance returns.

If the market moves against your position, losses may be amplified.

In a sideways market (no clear direction), daily leverage can cause the product’s value to erode over time, even if the underlying asset remains flat. This is known as the compounding effect or decay.

The product is rebalanced every night to maintain its targeted leverage level (e.g., x2 or x3). This means the exposure is adjusted daily, which significantly affects long-term performance.

A Bull or Bear certificate is a leveraged investment product with a constant daily leverage, designed to deliver a set multiple of the underlying asset’s daily performance (e.g., Bitcoin).

Bull = you expect the price to rise

Bear = you expect the price to fall

Disclaimer: As with any financial strategy, investors should be aware of the risks and limitations involved. The information contained above is not exhaustive and should not be relied upon as the sole basis for making investment decisions. Investors should consult the base prospectus for complete information on the investment product, including its terms, conditions, and risks involved.

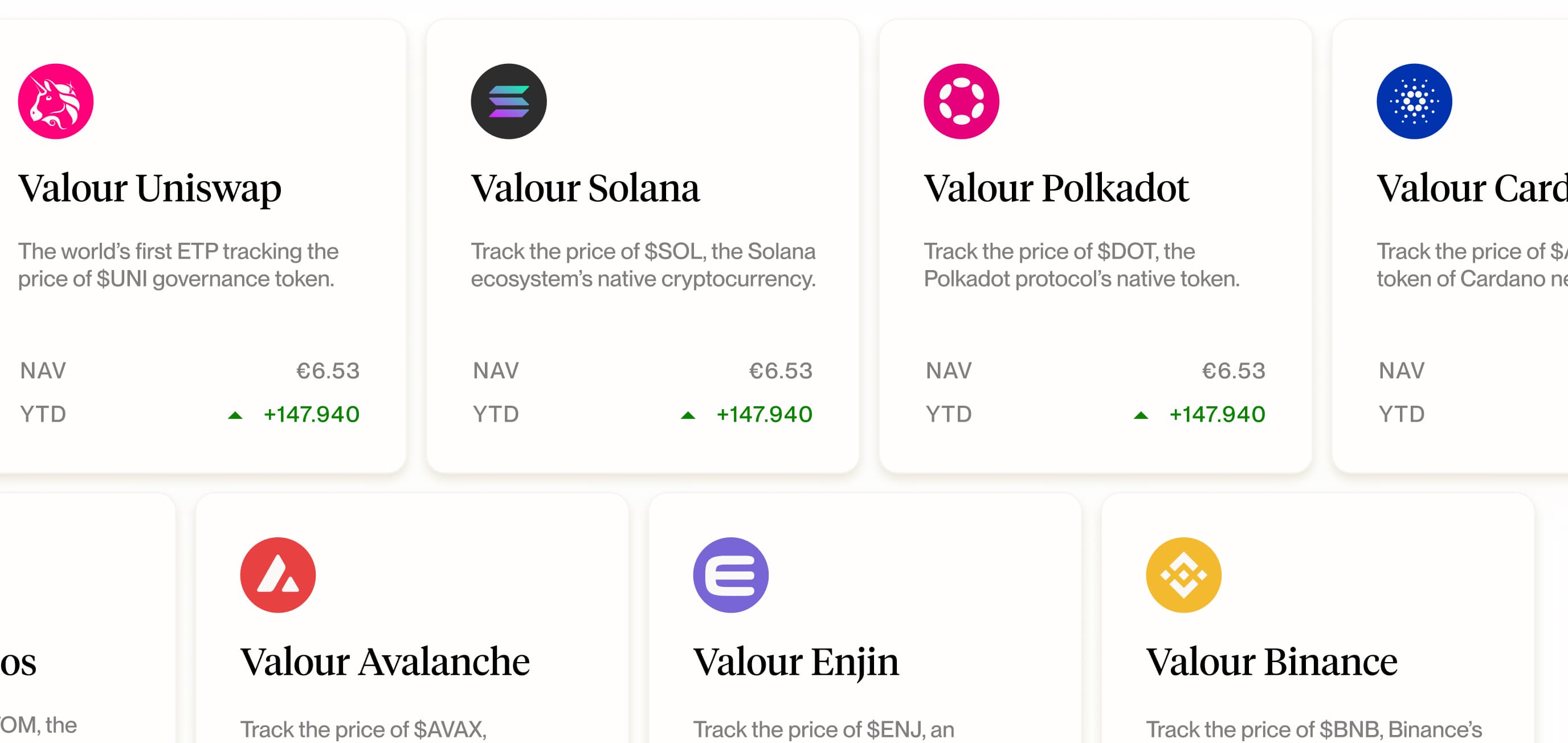

Earn more while spending less with our competitive management fees.

Access the future of finance with the security of regulated listings and licensed offerings.

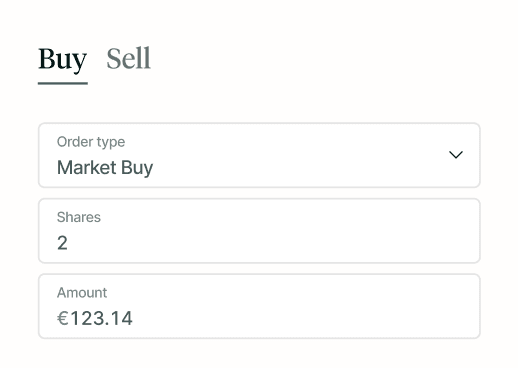

Trade Bitcoin and other digital assets without a dedicated crypto trading account.

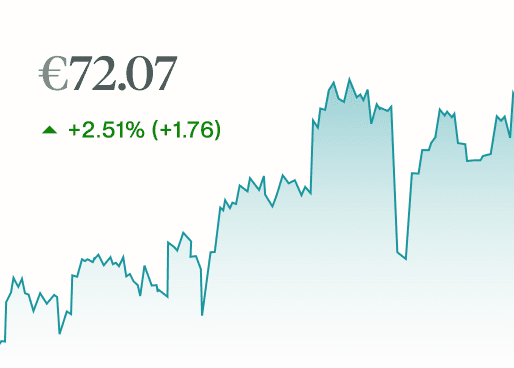

Clear, consistent link between price of the ETPs and the underlying asset